This article was published in The Malta Independent on Sunday - 19th October 2014

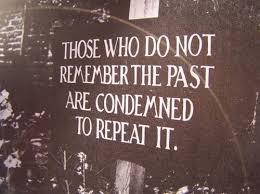

The fear of history repeating itself forced me to re-read the story of Germany between 1928 and 1933. By 1928, Germany was recovering well from the shattering experience of the First World War and the heavy reparation costs imposed on it by the 1918 Treaty of Versailles. Then, in 1929, disaster struck.

The Wall Street crash exported depression around the world and Germany was hit, as international trade collapsed, unemployment shot up and austerity was forced on people who were practically destitute. Fiscal and monetary policy tools had not yet been 'invented' to counter the economic cycle and, in any event, when a depression becomes global there is very little that a single country can do to avoid the fallout.

In this context, the Nazi movement was transformed from insignificance to the largest political party, with about one-third of the vote in the election of 1932, as it promised a better life to the 5.5 million unemployed. In 1933, Hitler was elected Chancellor, the Reichstag was burnt down during a fresh election campaign and, as public perception considered this an attempted coup by the 'communists', the Nazi party gained a sufficiently large electoral mandate to pass the Enactment law. Hitler began ruling by decree until he became a total dictator on the death of the German President in 1934. And the rest, as they say, is history.

Why is this relevant in today's circumstances? Europe is trapped in a never-ending recession and certain countries are now in outright depression. The argument as to whether this is best addressed by austerity (euphemistically often referred to as 'economic restructuring') or by demand stimulating growth policies continues and seems as fruitful as a dialogue between the deaf.

The German block, as the beneficiary of the crisis, keeps insisting that austerity is the best medicine. It expects countries in distress to regain their competitiveness by undergoing harrowing internal devaluation as the countries in surplus continue to reap the benefits of monetary union without making structural adjustment to address the disequilibrium from the surplus side as much as from the deficit side.

Countries in distress, particularly Italy, Spain and Greece but now joined by France, seem to have had enough of dictating by the Merkel clique and are insisting that fiscal flexibility must accompany economic restructuring as otherwise they will never escape the deflationary trap that will ultimately lead to default and collapse. All these countries will, in the next few years, face election campaigns (in Greece it could be as early as next year) and an electorate hurt and poisoned by austerity without a sign of redemption may well make the same decision as the one made by the German electorate in 1932-33. Parties of extremes - left, right or with no ideology apart from destroying democratic institutions - are not missing in all these countries.

Let me try to explain in language as plain as possible, both sides of the argument. The monetary union has rules about budget deficit and debt levels. These rules were recently (and very inappropriately) made more stringent to ensure that countries have no fiscal space for counter-cyclical demand management. Keynes must be turning in his grave. Germany insists on adopting a balanced budget, even though its seven per cent of GDP balance of payments surplus would indicate the need for stimulating internal demand to address this chronic surplus disequilibrium. It must be understood that surpluses and deficits are the opposite side of the same coin and no deficit can be successfully addressed unless surplus countries agree to share responsibility in the adjustment process.

When countries are in control of their own currencies, the rate of exchange operates as a self-correcting mechanism. If Germany still had its Deutsche Mark, this would have hardened so much on the international foreign exchange markets as to make Germany less competitive and thus adjust its surplus. Also, the strength of the Deutsche Mark would have forced the relocation of investment to the lower cost environment of deficit countries. However, as Germany's currency is now the euro - which is shared by countries whose economies are in distress - the euro does not re-value the way the Deutsche Mark would have done and therefore the self-correcting mechanism is distorted. Germany can continue to have a free lunch on the back of the countries in distress.

On the other hand, the countries in distress would have regained their competitiveness by a fall in their currency exchange if they still had their lira, franc, peseta or drachma. But as they now share the euro with Germany, the euro exchange cannot fall enough to offer a self-adjusting mechanism and these countries will have to work harder to regain their competiveness.

And herein lies the dialogue between the deaf. Germany is insisting that these countries regain their competiveness by means of economic restructuring, another word for internal devaluation, which essentially means outright cuts in wage levels and social entitlements and a reduction in government expenditure. According to the German doctrine, if these countries stick long enough with such painful austerity they will ultimately come out of the austerity tunnel in good shape, just as Ireland has managed to. The Germans have the audacity to state that deflation is a sanitary exercise to restore competitiveness and these countries should grind their teeth and keep inflicting pain on their population.

The Irish example is totally misleading. Even at the peak of the crisis, Ireland never lost its competitiveness and continued to attract foreign direct investment on a grand scale, given their US connections, their English speaking and their favourable tax environment. The Irish problem was caused through a property bubble that bankrupted its banking sector and the Irish government was forced to bail out its banks to ensure they honoured their obligations to other European banks. Basically, the Irish taxpayers had to bail out not just Irish banks but other international banks too!

Furthermore, the German logic does not take into consideration whether or not democratic institutions in problem countries have enough staying power to remain operative as they pass their electorate through the austerity sausage machine. Eventually, of course, if wages and entitlements fall enough to render the country competitive again, the economy will start to grow again. But could the electorate - in the painful process - be lured by the siren calls of the extremists, as happened in Germany in 1932-33 and from which there will be no point of return?

The argument from Valls and Renzi ('Vallenzi' has been coined by The Economist) is that whilst they will continue to restructure their economy to lubricate the rigidities and monopolies that have accumulated over a long period of time (Renzi is imposing, against foe and friendly resistance, a bold programme to restore flexibility to the labour market and make the judicial system more effective) this cannot be done in the context of fiscal austerity. They plead to be allowed space to stimulate the economy so that the restructuring can be carried out in the context of economic growth if they are to maintain their political constituency.

To this Chancellor Merkel has gone to the German parliament to emphasise that:

"All member states must accept in full the strengthened rules of the Euro......In Europe we have to look first and foremost at mobilising private capital."

The two sides are entrenching themselves without room for compromise. Efforts to mobilise investment through the Europe Investment Bank for infrastructure can only be viewed as a long-term solution, with little or no immediate impact. Such infrastructure projects, even if defined as shovel-ready, would require a long lead time to organise, finance and obtain all regulatory and environmental approval, so their impact for instant impetus to render 2015 growth would be next to negligible.

Germany seems determined to stick to the stern defence of their orthodoxy and surpluses, even as their own economy is being hit by lower demand from export markets. Italy and France have had enough of German diktats and very soon something will have to give. Hopefully, good sense will prevail to ensure that history does not repeat itself.