In justifying their decision to downgrade Malta to A3 from A2 and still maintain negative outlook, Moody's gave as their reason that Malta has poor debt dynamics compared to category A peers. They made this point three times in the few paragraphs of explanation they gave for the downgrade.

In justifying their decision to downgrade Malta to A3 from A2 and still maintain negative outlook, Moody's gave as their reason that Malta has poor debt dynamics compared to category A peers. They made this point three times in the few paragraphs of explanation they gave for the downgrade.What are debt dynamics?

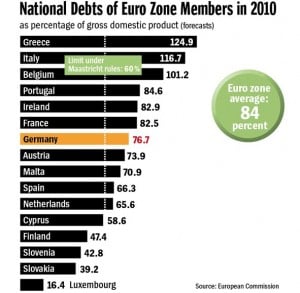

When you are in debt, the question is not by how much, but whether your economic circumstances are favourable to paying off the loan. If one has a loan of EUR 10,000 but earns EUR 50,000 stably each year their debt dynamics are much better than someone who has a debt of EUR 5000 but only earns EUR 10000 each year in a stable and reliable manner.

So what are Moody's telling us when they say that our sovereign debt dynamics are weak compared to peers? In simple language they are telling us the following:

- Government revenues has a recurrent element of one-off transactions which cannot be relied upon consistently for the future.

- Malta's growth is very much dependant on what is happening around us and if these circumstances, even through no fault of our own, force us to little or no growth, government debts will start rising faster than economic growth.

- Government may have to absorb on its books a good part of the debt for which it is responsible through contingent guarantees in favour of banks who are lending to national corporations like Enemalta and Freeport, only because government agrees to offer its guarantee cover.

- Government is committed to substantial expenditure for social services which can only be sustainable in the context of strong economic growth. Absent such growth, these expenditures will translate into into higher deficits and higher debts.

Basically we need strong economic growth to remain sustainable. Moody's and their peers are not at all convinced that our growth projections are realistic especially considering what is happening around us.

It's hard to fault them for such reasoning.

Our energies should be channelled to generating growth, to proving them wrong and to relate our experience that we do best when all around us is falling apart. Last year we had the best performance of the tourism industry in spite of all the the instability around us, north and south. In the seventies during the oil price shock we managed to attract a huge inflow of FDI that was searching for a lower cost base to remain competitive. Such industries like Playmobil, Actavis, Baxter etc have their origins in such circumstances. ST Thomson came during the second oil crisis of late seventies early eighties.

Growth needs investments and investments need stability. If we can achieve stability when all around us is unstable so much the better. But stability needs respect of democracy and if government cannot be sure of a majority in parliament it would be playing with fire in our debt dynamics if it persists purely to position itself better for re-election prospects.

As a nation we need to show Moody's and peers that we are a mature nation, that we can raise to the challenges and we are at our best when things get rough.

No comments:

Post a Comment